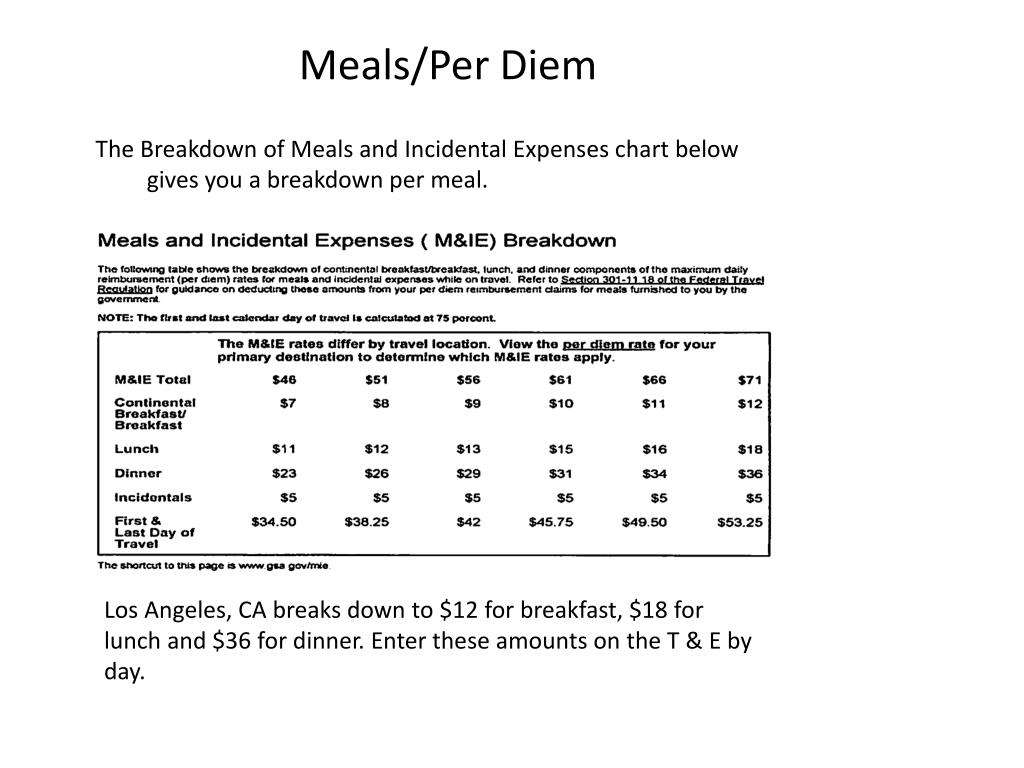

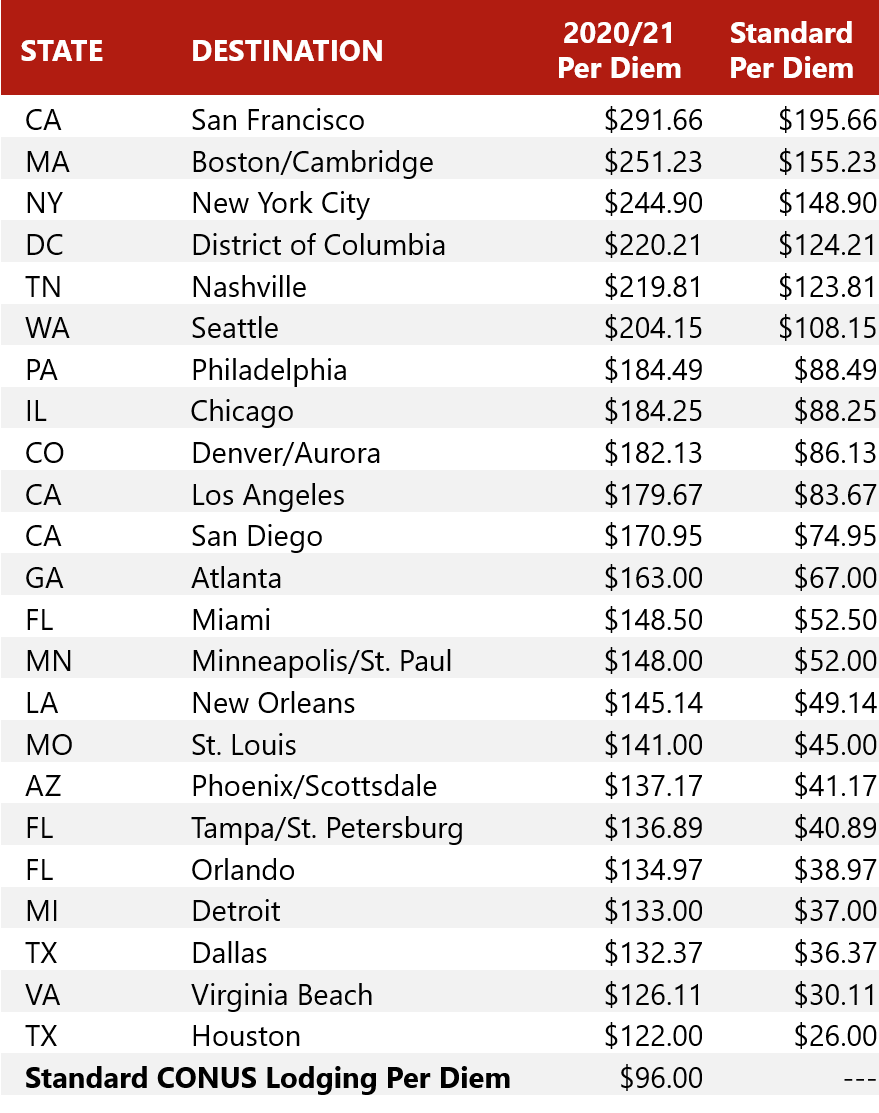

Irs Per Diem Rates 2025 Meals And Lodging Foremost Notable Preeminent. The standard lodging rate for most of conus raised to $110 per day. Given the many expenses business travelers need to track (hotels, meals, etc.), the irs permits employers to pay per diem rates—daily allowances that cover meals, lodging, and.

Given the many expenses business travelers need to track (hotels, meals, etc.), the irs permits employers to pay per diem rates—daily allowances that cover meals, lodging, and. According to the gsa per diem 2025 highlights, not much has changed from last year’s rates. We establish the per diem rates that federal agencies use to reimburse their employees for lodging and meals and incidental.

Source: mirnahjkneilla.pages.dev

Source: mirnahjkneilla.pages.dev

Irs Per Diem Rates 2024 Meals Goldy Karissa According to the gsa per diem 2025 highlights, not much has changed from last year’s rates. We establish the per diem rates that federal agencies use to reimburse their employees for lodging and meals and incidental.

Source: patriciarpruitt.pages.dev

Source: patriciarpruitt.pages.dev

Gsa Meal Per Diem 2025 Patricia R. Pruitt The standard lodging rate for most of conus raised to $110 per day. According to the gsa per diem 2025 highlights, not much has changed from last year’s rates.

Source: jenniferlnewcomer.pages.dev

Source: jenniferlnewcomer.pages.dev

Per Diem Rates 2025 Washington Dc Jennifer L. According to the gsa per diem 2025 highlights, not much has changed from last year’s rates. Given the many expenses business travelers need to track (hotels, meals, etc.), the irs permits employers to pay per diem rates—daily allowances that cover meals, lodging, and.

Source: maeasmith.pages.dev

Source: maeasmith.pages.dev

Irs Meal Rate 2025 Mae A. Smith Given the many expenses business travelers need to track (hotels, meals, etc.), the irs permits employers to pay per diem rates—daily allowances that cover meals, lodging, and. According to the gsa per diem 2025 highlights, not much has changed from last year’s rates.

Source: forrestlhall.pages.dev

Source: forrestlhall.pages.dev

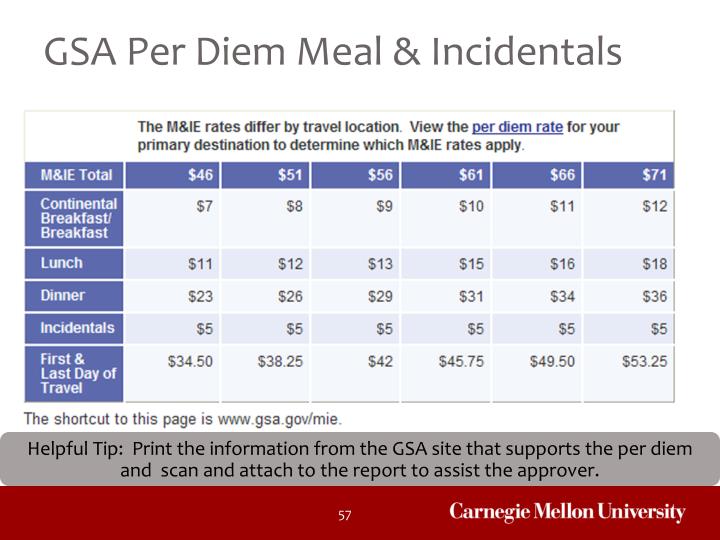

2025 Irs Per Diem Rates Forrest L Hall The transportation special meals and incidental expense (m&ie) rates increase significantly from the 2024 rate of $69 per day to $80 per day in 2025 for any locality of travel within the continental united states (conus) and $86 per day for any locality of travel outside the continental united states (oconus). The standard lodging rate for most of conus raised to $110 per day.

Fy 2025 Per Diem Rates For Texas Landon Blake Given the many expenses business travelers need to track (hotels, meals, etc.), the irs permits employers to pay per diem rates—daily allowances that cover meals, lodging, and. According to the gsa per diem 2025 highlights, not much has changed from last year’s rates.

Source: rickilinette.pages.dev

Source: rickilinette.pages.dev

Irs Per Diem Meal Rates 2025 Layla Anastasie The transportation special meals and incidental expense (m&ie) rates increase significantly from the 2024 rate of $69 per day to $80 per day in 2025 for any locality of travel within the continental united states (conus) and $86 per day for any locality of travel outside the continental united states (oconus). Given the many expenses business travelers need to track (hotels, meals, etc.), the irs permits employers to pay per diem rates—daily allowances that cover meals, lodging, and.

Source: aidanmustafa.pages.dev

Source: aidanmustafa.pages.dev

Irs Publication 2025 Per Diem Rates 2025 Aidan Mustafa The transportation special meals and incidental expense (m&ie) rates increase significantly from the 2024 rate of $69 per day to $80 per day in 2025 for any locality of travel within the continental united states (conus) and $86 per day for any locality of travel outside the continental united states (oconus). We establish the per diem rates that federal agencies use to reimburse their employees for lodging and meals and incidental.

Source: patriciarpruitt.pages.dev

Source: patriciarpruitt.pages.dev

Gsa Meal Per Diem 2025 Patricia R. Pruitt According to the gsa per diem 2025 highlights, not much has changed from last year’s rates. Given the many expenses business travelers need to track (hotels, meals, etc.), the irs permits employers to pay per diem rates—daily allowances that cover meals, lodging, and.

Source: cesyaykiersten.pages.dev

Source: cesyaykiersten.pages.dev

Irs Per Diem Mileage Rates 2025 Belia Kailey Given the many expenses business travelers need to track (hotels, meals, etc.), the irs permits employers to pay per diem rates—daily allowances that cover meals, lodging, and. The standard lodging rate for most of conus raised to $110 per day.

Source: janepaterson.pages.dev

Source: janepaterson.pages.dev

Irs Per Diem Rates 2025 Washington Dc Jane Paterson Given the many expenses business travelers need to track (hotels, meals, etc.), the irs permits employers to pay per diem rates—daily allowances that cover meals, lodging, and. The standard lodging rate for most of conus raised to $110 per day.

Source: elizabethmdahl.pages.dev

Source: elizabethmdahl.pages.dev

Per Diem 2025 Cambridge Ma Elizabeth M. Dahl According to the gsa per diem 2025 highlights, not much has changed from last year’s rates. We establish the per diem rates that federal agencies use to reimburse their employees for lodging and meals and incidental.